Banking, insurance, trading, risk management … whatever industry your company belongs to, you know better than anyone that financial technologies must become part of your business story.

As incredible as it may seem to us today, this is how things worked when digitalization was only a promise with no deadline attached. (the biggest challenge being not only the technology but also the people’s willingness to embrace digitalization)

In the past 8 months, the new context forced people to educate themselves from the digital perspective. Customers, business owners, financial teams, etc., understood that procrastinating the adoption of digitalization is no longer a matter of choice and that it has to be done in no time.

So, here you are. Searching for the right digital solution that will help your business to look and feel digital-savvy.

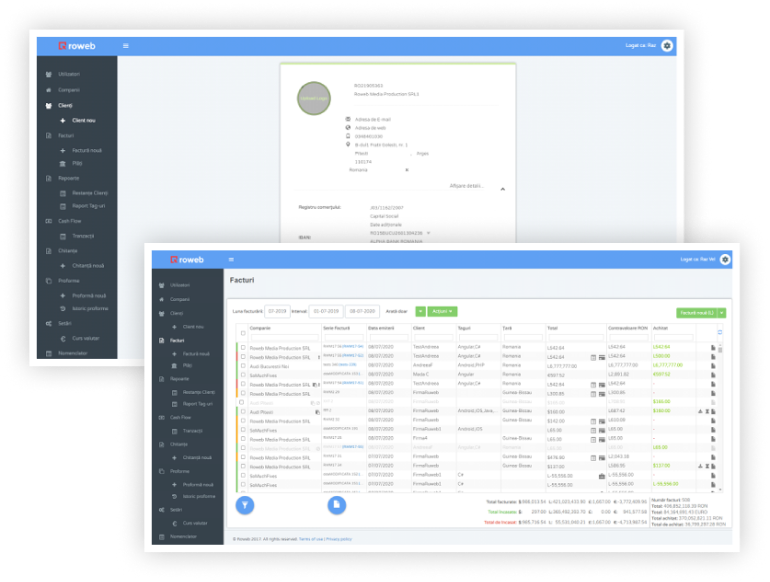

#1 Simplify transactions & track the documents flow/client’s status by developing and implementing an invoice/finance management software

This invoice/finance management software will be very useful for both accounting departament and top management:

- accounting department – easy and safe data management, fast access to financial documents, smart data displaying and filtering, etc.

- top management – quick overview of the customers’ status and transactions’ evolution, plus easy access and transfer for the financial documents (anytime is needed).

By developing a finance management software, you’ll have access to several features:

- flexible tools for data management and export;

- smart data displaying (listing, filtering, charts) for a faster and better overview;

- automated processes for eliminating redundant and time-consuming activities (e.g., transforming the proforms into invoices, exchange rate listing, and management, etc.)

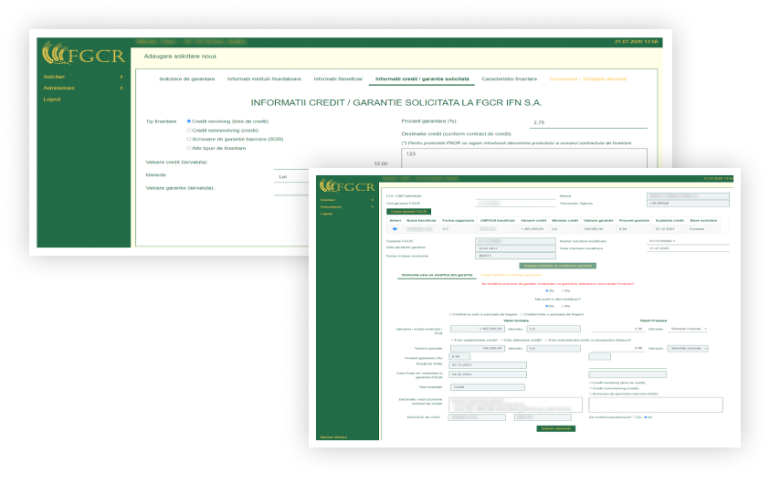

#2 Unify multi-parties financial processes by using a dedicated financial management web app

This type of solution is very useful when your financial activities involve multi-party entities (clients, external institutions, and your company).

For example, let’s say you offer a financial product that needs approval from a bank. Usually, the client has to take into account several steps for obtaining the product – completing request forms, bringing supporting documents, requesting validation and approvals, etc. All these steps involve great effort and time consumption.

On the other hand, disparate activities and working with several platforms (that are not synchronized) generate a high risk of errors and delays in the process.

So, using a dedicated financial management web app allows you to:

- offer online registration of requests (and to send them automatically to the financing institutions /banks);

- get faster and simplified exchange of documents between the parties involved in the processes;

- benefit from optimized workflows for the entire financial process.

EARLY ADOPTION OR CUSTOMIZED SOFTWARE SOLUTIONS?

Whatever your need is, we adapt fast to it and deliver you exactly the solution that suits your interests best.

#3 Offer digital-only solution to solve the most frequent financial activities of the clients

Digital-only solutions are efficient ways to bring the most used financial tools (e.g., money transfer, exchange, pawn, etc.) at your customers’ fingertips (both figuratively and literally).

The solution must be developed based on a cross-devices journey scenario, so your client has constant access to the digital tools he is interested in.

Types of features you can choose to integrate in the digital-only solution:

- real-time calculator;

- on-app transactions;

- direct contact tool;

- updated info;

- smart and secure registration and login;

- transitioning history;

- etc.

You can opt for developing a web-only solution (e.g., a website optimized for mobile), or develop a suite of integrated solutions (e.g., website + mobile app + CRM)

#4 Provide access to a 360° customer-centric mobile app

Usually developed for banking services, this app is a great opportunity to place everything a customer needs and expects in one place:

- movements;

- transfers;

- cards;

- market overview;

- online trading;

- mails;

- announcements;

- info and tech support;

- etc.

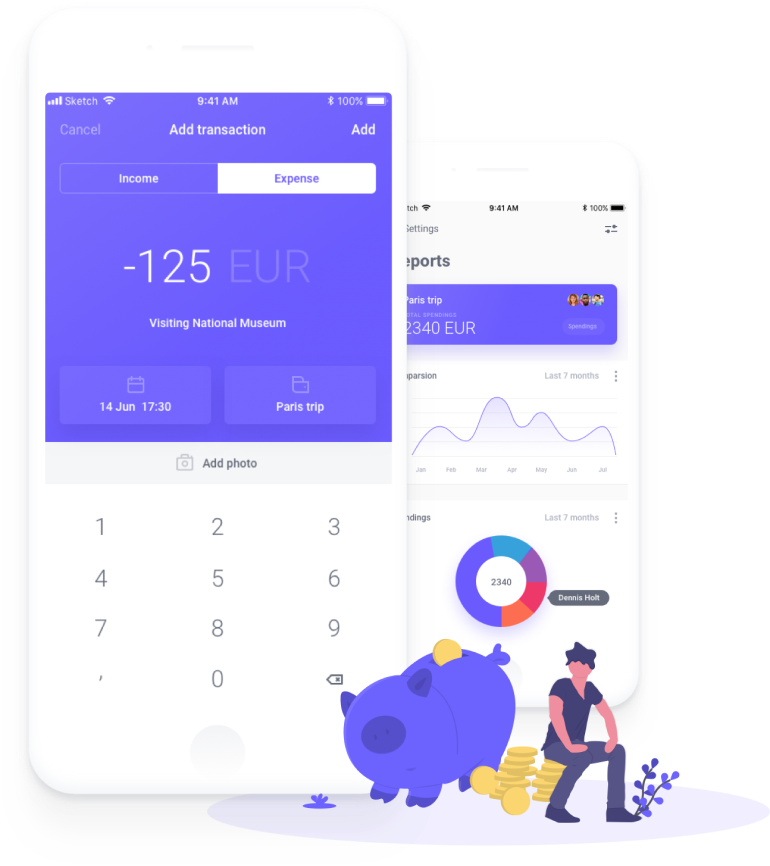

#5 Increase customers’ engagement with an intuitive and collaborative finance app

The opportunities for developing finance management apps for customers are unlimited. Literally.

- Shared wallets – for easy management of shared expenses

- Monthly expense tracker – transactions and spends management

- Personal financial analyzer – to track financial goals and gaps

- Get-your-plan app – for shortening the process of getting a customized quotation

- Insurance-broker – to give users a real-time overview of what insurance companies offer

Need an example? Take a look at the following project:

Shared Pockets: one of the first collaborative and the most user-friendly and customizable budgeting app currently on the market.

Users can install it for free and start organizing their income streams, tracking their expenses, and managing their budget, including for goals where they’re pooling in money with other users, in any currency that they need, as well as for cryptocurrencies and gas.

Read more

Instead of conclusions (some takeaways):

- It’s essential to know from the start what you want and need: a full-customized solution (made from scratch) or a fast development (based on a predefined solution architecture)?

- Developing a financial solution by keeping the user in mind may seem overwhelming. That’s why most of our clients request a consultation session first – so we can give them pre-developing pieces of advice.

- Postponing the development of a digital solution for financial activities may cost you a lot: errors and delays among the processes, lost opportunities in positioning on the market, unhappy clients who choose competition’s services instead of yours, etc. So, why waiting when you can start a conversation with one of our experts?

Not sure what type of digital solution suits best your company’s interests?

Get advice from Roweb’s experts